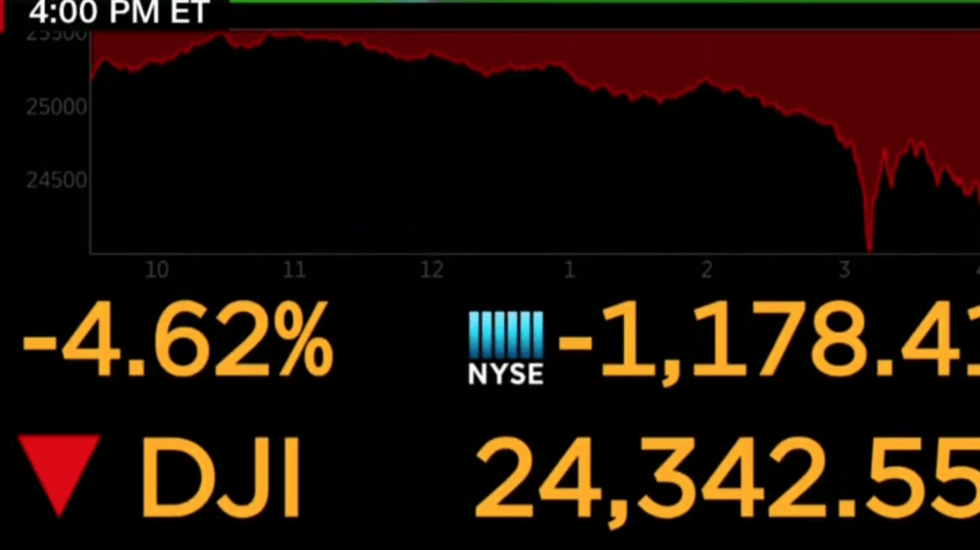

A record-breaking day for the Dow Jones, but not one Donald Trump is likely to brag about. For the first time in market history, the Dow closed down more than 1000 points. At the bell, it was down 1179 points. The next biggest drop was on September 29, 2008, when it dropped more than 777 points.

Between Friday’s drop of 665 points and today’s fall off, the market has erased all its gains for 2018. At one point the market was down 1600 points on Monday.

The percentage drop is not history-making, but it does rank in the top 20 worst days.

What’s driving the dive? Analysts point to a market that has shot straight up. A correction like this was expected, and many say healthy. We may not have seen the bottom just yet. With a new Fed chairman coming on board and a hot market, there are worries of inflation which could lead to higher interest rates.

Here’s more perspective.

Art Cashin: The stock market 'snapped like a twig' and may take a day or two still to find bottom https://t.co/9iQxblmusc

— CNBC (@CNBC) February 5, 2018

Dow industrials plunge more than 1,100, the biggest one-day point drop ever, in a volatile session that erases 2018 gains https://t.co/swBpCKtX7E

— The Wall Street Journal (@WSJ) February 5, 2018

The stock selloff is starting to cast doubt on future Fed rate increases https://t.co/LR7T5FI5uJ pic.twitter.com/IaVCKAJ7nB

— Bloomberg Markets (@markets) February 5, 2018